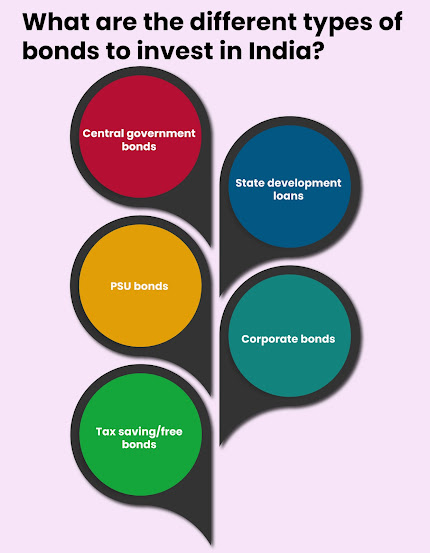

Explore the Different Types of Bonds Available in India

Bonds are an attractive investment option for many individuals in India looking to grow their wealth over time. With so many different types of bonds available, it can be difficult to know where to start. In this article, we'll explore the different types of bonds available in India, their key features, and the benefits they offer to investors.

Corporate Bonds

Corporate bonds are issued by companies to raise capital for various purposes, such as expanding their business or investing in new projects. They offer a fixed rate of return and are typically considered to be low-risk investments, making them a popular choice for conservative investors.

Government Bonds

Government bonds, also known as sovereign bonds, are issued by the government of India to raise funds for various initiatives and projects. These bonds are considered to be low-risk and offer a relatively stable return, making them an attractive investment option for those seeking a reliable source of income.

Tax-Free Bonds

Tax-free bonds are issued by government-owned entities, such as public sector companies and local authorities. As the name suggests, the interest earned on these bonds is exempt from tax, making them an attractive investment option for those looking to maximize their returns.

Infrastructure Bonds

Infrastructure bonds are issued by companies engaged in the development of infrastructure projects, such as roads, bridges, and power plants. These bonds offer a higher rate of return compared to other types of bonds and are typically considered to be medium-risk investments.

Municipal Bonds

Municipal bonds are issued by local authorities, such as cities and towns, to raise funds for various projects, such as building schools and hospitals. These bonds offer a stable return and are considered to be low-risk investments.

Savings Bonds

Savings bonds are issued by the government of India and are designed to encourage people to save money. They offer a fixed rate of return and are considered to be low-risk investments.

Conclusion

Bonds are a versatile investment option that can help you achieve your financial goals, whether you're looking for steady income, long-term growth, or a combination of both. With so many different types of bonds available in India, it's important to consider your individual needs and goals before making a decision. It's also important to consider factors such as risk tolerance, investment horizon, and expected return when choosing the right bond for you.

.jpg)

Comments

Post a Comment