What is the Future of the Bonds Market in India?

Introduction

One of the most vibrant markets in the emerging markets is the Indian bond market, which has been experiencing rapid growth.

Improved interest rates, easier access to instruments, and better liquidity have been a few driving forces behind this expansion.

India’s bond market has grown significantly in recent years, but there is still a long way.

The recent events may take the country’s bond market in a new direction and could have a long-lasting impact.

This article will cover these events and how they can affect the Indian bond market.

Future of the bonds market in India

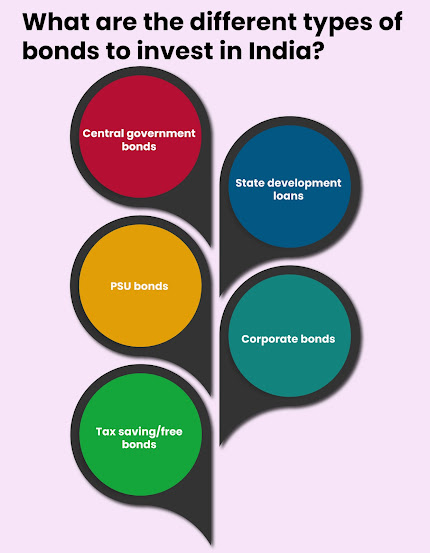

Different types of bond market in India exist.

Based on the type of bond, the bond market can be government, corporate, municipal bond market, etc.

Based on the type of buyer, the bond market can be separated into - primary and secondary bond markets.

The following events can affect the future of the bond market in India:

1. India’s inclusion in the global index

The government of India has announced a plan that would allow foreign investors to buy select government bonds without any limit. This new policy was a significant shift followed by India’s inclusion in the global index.

In early 2022, India is expected to be included in the global bond indices. This is projected to bring over $40 billion in funds from investors in the 22/23.

This means more bond investment. Indian bond market could reach new heights due to this.

With India’s bond market opening up, the rupee can get a much-needed boost. Capital will be diversified quickly, making it more stable and robust.

Further, opening up government securities to foreign investors is a bold move that indicates India’s confidence in its stability.

2. Increasing liquidity in the corporate bond market

The recent budget proposed that there must be a market-making entity for corporate bonds.

This will have a lot of benefits, such as supplying much-needed liquidity to the bond market and making it easier for investors to be more comfortable with bonds.

The next few years will see NBFCs and housing finance companies float Rs. 14-15 lakh crore of corporate bonds, making it a key funding source.

Due to this, the total corporate bond supply will more than double in the next five years, going from Rs 33 lakh crore in 2020 to Rs 65-70 lakh crore in 2025.

3. India’s infrastructure development

The government’s focus on investment in the infrastructure sector will increase the bond market action in India.

It is believed that the government will spend about Rs. 111 lakh crore between 2020 and 2025 for the development. This could bring a significant boost to the Indian bond market.

4. More green bond issuance

In 2021, India issued around $6.11 billion in green bonds, and by 2022 it is expected to reach new heights.

Indian companies are finally getting serious about their carbon footprint. To fund the country’s growing energy transition, more banks are issuing green bonds. This will help India develop more quickly and limit its carbon footprint by 2070. However, for that, they will need around $10 trillion.

India’s green bond market is much smaller than China’s. However, it points to the country’s potential for growth. The green bond issuance in 2023 could hit $1 trillion.

Increasing green bond issuance could signify more inflows in the bond market; thus, the Indian bond market will flourish in the decades to come.

Conclusion

Bonds are one of the oldest forms of investment in India. The Indian bond market is more of a government bond than a corporate bond market.

The Indian bonds market has been booming, and it is here to stay. The scope of the market has also been expanding with government initiatives, which has led to a rise in investments in the bonds market by domestic and foreign investors.

The positive sentiments on the market have led to the hike in the volumes of transactions, which have constantly been growing.

If you wish to know how to purchase bonds in India, visit https://www.bondsindia.com/.

Comments

Post a Comment