What's The Difference Between Bonds And Debentures?

Bonds and debentures are a type of debt instrument. Bonds are most often issued by companies and governments, while debentures are usually issued by corporations. The primary difference between the two is that bonds have fixed interest rates, while debentures vary in interest rate depending on the discretion of the issuer.

Introduction

Bonds and debentures are both types of debt securities. A bond is a debt security in which the issuer promises to pay the holder a certain amount of interest over a specified period of time, and to repay the principal at maturity. A debenture is a debt security in which the issuer does not promise to pay any interest, but does promise to repay the principal at maturity.

What Is A Bond?

A bond is a debt security, similar to an IOU. Bonds are issued by governments and corporations when they need to raise money. Investors who purchase bonds loan money to the issuer in exchange for periodic interest payments and the return of their principal when the bond matures.

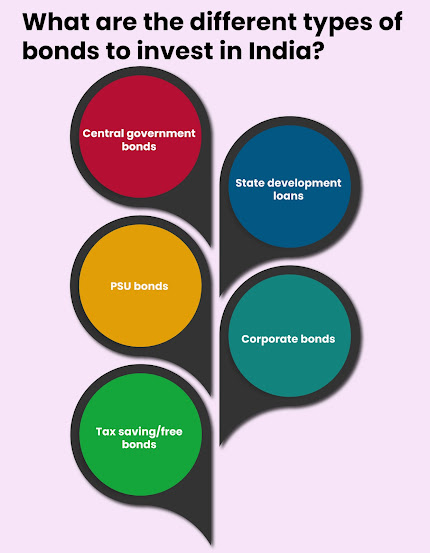

There are many different types of bonds, but they all share some common features. For example, all bonds have a face value, which is the amount that will be repaid to the investor at maturity. Bonds also have a coupon rate, which is the interest rate that will be paid to the investor on a regular basis. The frequency of payments depends on the type of bond: some bonds make payments monthly, while others make payments every six months or once per year.

Bonds are typically issued for terms of one year or longer. The longer the term of a bond, the higher its yield (the annual return that an investor receives). This is because investors require a higher yield to compensate them for tying up their money for a longer period of time.

When a bond matures, the issuer repays the face value of the bond to the investor. This repayment represents the return of the investor's principal. In addition, most bonds make periodic interest payments to investors during their lifetime (known as coupon payments). These payments represent the return on investment for bondholders.

What Is A Debenture?

A debenture is a type of debt instrument that is not secured by collateral. Debentures are backed only by the creditworthiness and reputation of the issuer. This makes them a higher risk investment, but also one that typically offers a higher yield than secured bonds.

Who Issues Bonds And Debentures?

Bonds and debentures are both financial instruments that are used by companies to raise capital. Bonds are issued by governments and corporations, while debentures are issued by banks and other financial institutions.

The main difference between bonds and debentures is that bonds are secured by the issuer's assets, while debentures are unsecured. This means that if the issuer defaults on the bond, the bondholders have a claim on the issuer's assets. However, if the issuer defaults on a debenture, the debenture holders do not have any claim on the issuer's assets.

Another difference between bonds and debentures is that bonds typically have a fixed interest rate, while debentures typically have a variable interest rate. Bondholders also have priority over debenture holders if the issuer goes bankrupt.

How Much Do Bonds And Debentures Cost To Buy?

Bonds and debentures are both debt instruments that are used by companies to raise capital. Bonds are typically issued by larger, more established companies with a good credit rating, while debentures are usually issued by smaller companies or those with a less-than-stellar credit rating.

The cost of bonds and debentures will vary depending on the issuer, the type of instrument, and the current market conditions. For example, government bonds tend to be very stable and low-risk, so they will typically yield lower returns than corporate bonds. However, corporate bonds may offer higher returns but also come with more risk.

To get an idea of how much bonds and debentures might cost to buy, investors can check out online calculators or speak to a financial advisor. The important thing is to do your research and understand the risks involved before making any investment decisions.

Why Should I Invest In Bonds Or Debentures?

When it comes to investing, there are a lot of options available. But two of the most popular options are bonds and debentures. So, what's the difference between the two?

Bonds are essentially loans that you make to a company or government. In exchange for your loan, they agree to pay you interest over a set period of time. Debentures are similar to bonds, but they're usually issued by companies rather than governments.

Both bonds and debentures can be great investments. They tend to be relatively low-risk, which means you're unlikely to lose your entire investment if something goes wrong. And, because they offer regular interest payments, they can provide a nice steady income stream.

So, which should you invest in? Ultimately, it depends on your personal goals and preferences. If you're looking for stability and income, bonds may be the better option. If you're willing to take on a bit more risk for the chance of higher returns, debentures may be right for you.

Conclusion

Bonds and debentures are two types of debt instruments that companies use to raise capital. Both have their own advantages and disadvantages, so it's important to understand the difference between them before deciding which one is right for your business. In general, bonds tend to be more stable than debentures, but they also typically offer lower returns. Debentures, on the other hand, are generally more volatile but offer higher returns. Ultimately, it's up to you to decide which type of instrument is best for your company's needs.

Comments

Post a Comment